Embed SEPA payments, automate reconciliation, and turn your software into a fintech powerhouse—with one API.

Assign unique IBANs to invoices via API. Get real-time SEPA Instant IPNs that auto-reconcile payments with invoices in your ERP.

Offer 27 local IBANs to eliminate cross-border payment friction. Simplify operations—no need to juggle multiple banks or PSPs.

Enable programmable fund flows, automate payouts, and create flexible payment terms tailored to your clients’ needs—all through one robust API.

Transform your platform into a financial hub. Upsell premium features like instant settlements, FX services, or cashflow analytics through embedded finance solutions.

Why smartIBAN?

Traditional solutions lack agility. smartIBAN gives you the edge:

smartIBAN advantage

Automated invoice-to-payment reconciliation

Real-time IPNs for instant updates

Unlimited IBANs via API

Upsell payments, FX, analytics

Lower bank fees, no chargebacks

GDPR-ready, PSP-licensed infrastructure

Traditional solutions

Manual reconciliation

Delayed SEPA notifications

Limited IBAN availability

Stagnant revenue

High card fees

Fragmented compliance

How it works

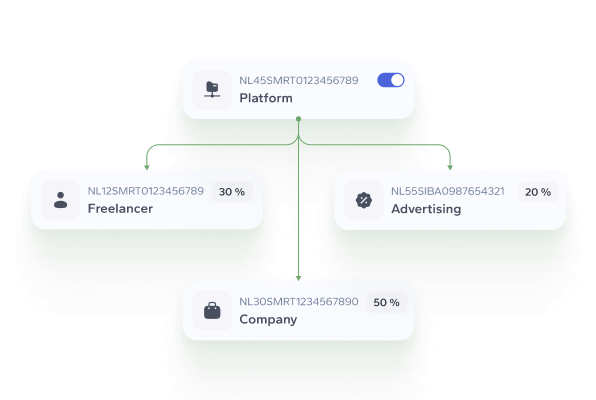

Generate IBANs: Auto-create virtual IBANs for clients to receive payments directly in their name.

Collect Payments: Accept SEPA transfers from buyers into local IBANs for seamless transactions.

Reconcile Instantly: Use real-time IPNs to sync transactions with your invoicing or ERP system.

Automate Payouts: Trigger payouts to vendors or clients with programmable rules.

Scale Effortlessly: Manage multi-country payments through one API that supports unlimited IBANs.

Only

of B2B businesses experience delays in payment reconciliation due to outdated systems. smartIBAN solves this with real-time IPNs and automated workflows.

Welcome to our website, where you can learn more about our upcoming services. Please note that we are not yet operational and are not accepting clients at this time. However, we invite you to explore our open positions. smartIBAN is not a bank and does not intend to become one.

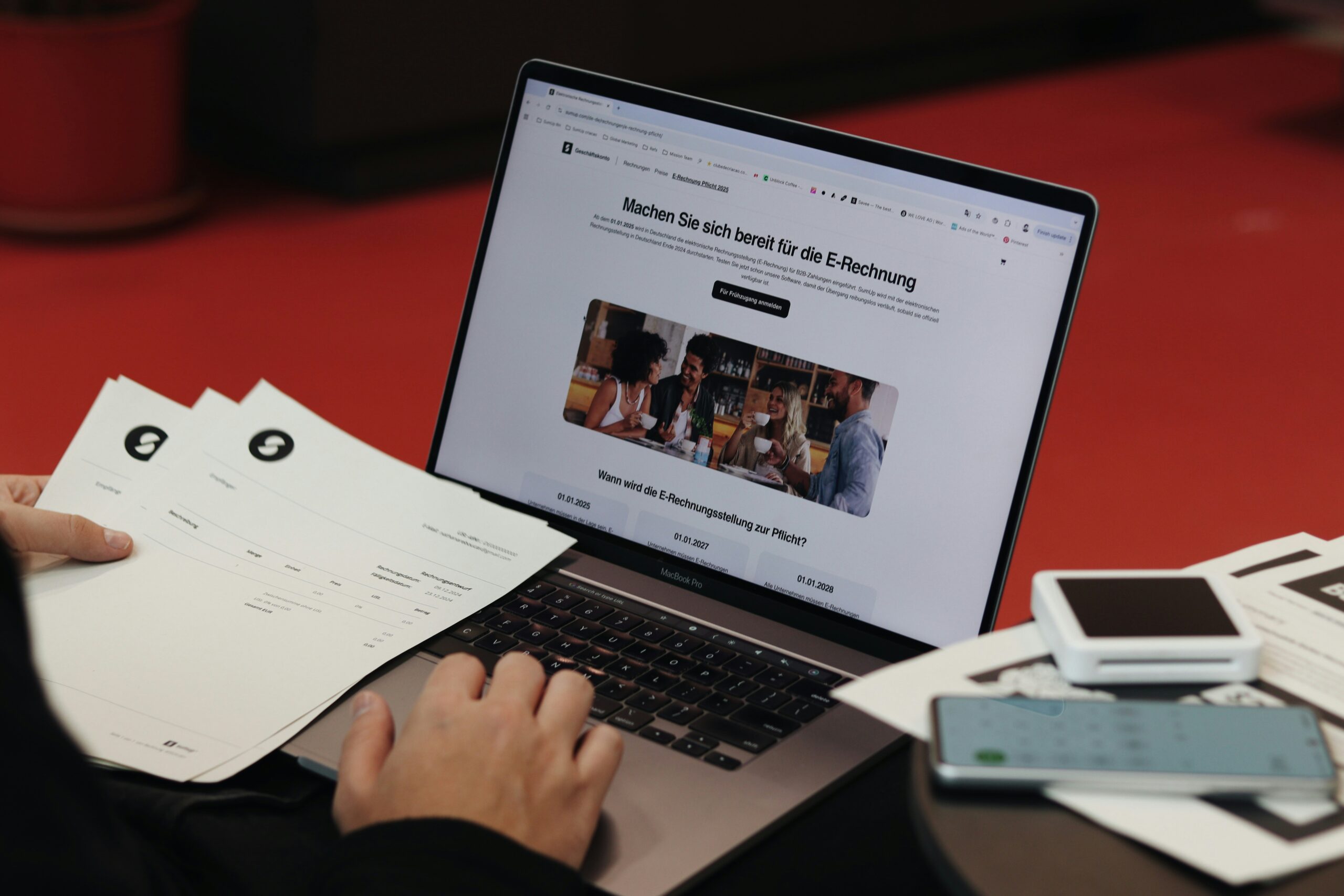

Tailored for Invoicing & ERPs

Offer suppliers local IBANs for faster, cheaper payments.

Replace clunky card systems with SEPA Instant and auto-reconciliation.

Enable compliant sub-accounts for freelancers or sellers, ensuring transparency and trust.

Scale with smartIBAN

Streamline reconciliation, enable localized payments, and create flexible financial workflows—all through one API.

Built for the future of invoicing. No legacy BS.