A compliant-driven APM that scales up your business and your clients’ businesses.

Automatically create unlimited IBANs for merchants to send settlements. No manual onboarding—scale with API-driven account generation.

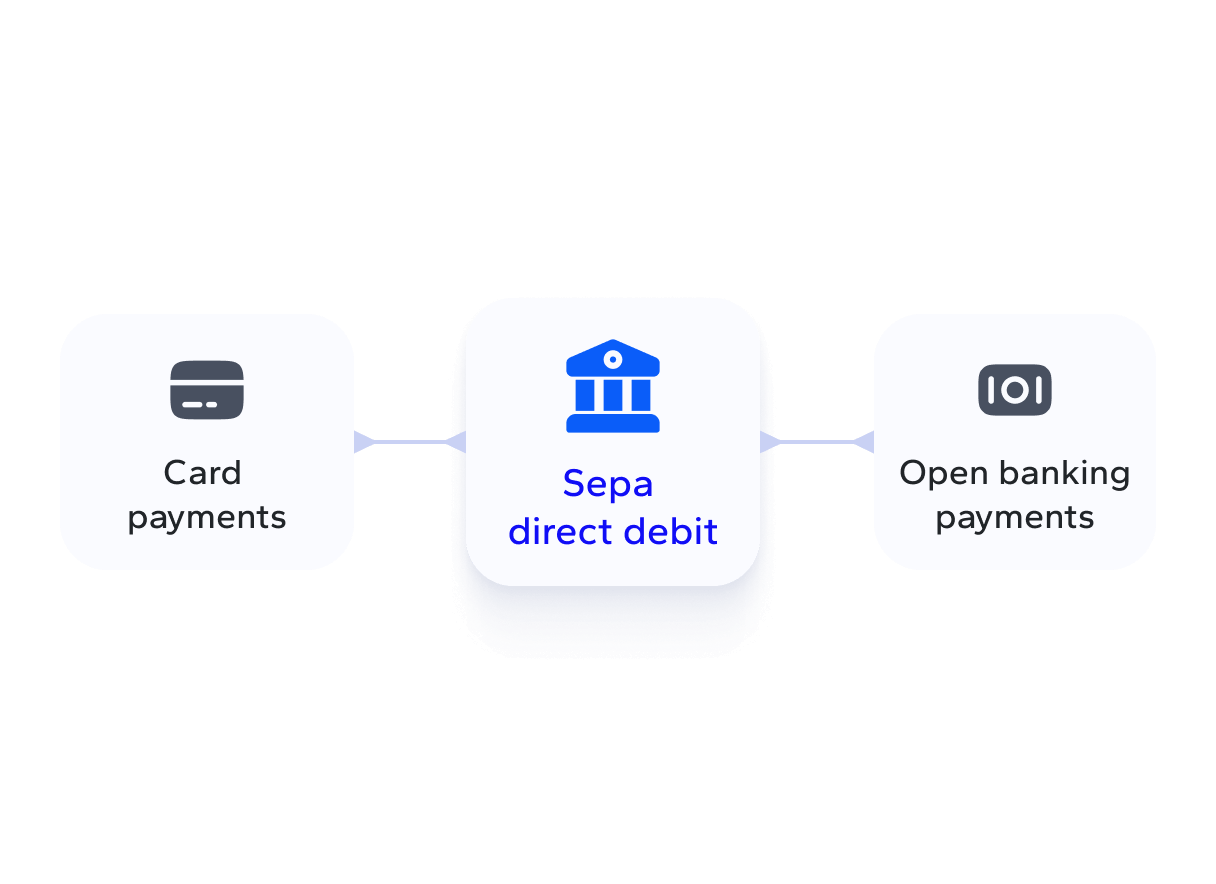

Add a card-like APM that works seamlessly across all 27 EU countries. Offer merchants local bank payments with higher conversions and lower fees than cards.

Get instant SEPA alerts for every transaction. Sync with merchant systems to automate reconciliations and reduce fraud risks.

The smartIBAN advantage

Traditional solutions lack agility. smartIBAN gives you the edge:

smartIBAN advantage

27 European countries covered

Automate payouts with programmable rules

Lower fees, no fraud

Generate unlimited IBANs via API in seconds

PSP-licensed infrastructure built for EU

Traditional solutions

APMs with limited coverage

Manual settlement processes

High card fees & chargebacks

Limited IBAN availability

Fragmented compliance

Welcome to our website, where you can learn more about our upcoming services. Please note that we are not yet operational and are not accepting clients at this time. However, we invite you to explore our open positions. smartIBAN is not a bank and does not intend to become one.

How it works

Add smartIBAN: Integrate into your stack via API to offer merchants profitable and localized options.

Generate Accounts: Auto-create IBANs for merchants to receive settlements directly in their name.

Money In: Collect SEPA payments from buyers into local IBANs, ensuring seamless and frictionless transactions.

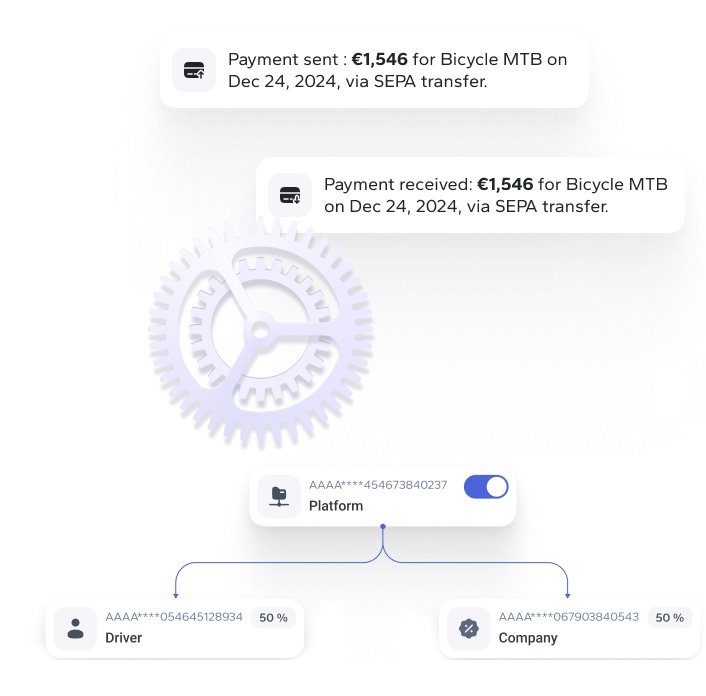

Automate Settlements: Trigger instant payouts with programmable rules, reducing errors and saving time.

Reconcile Instantly: Use real-time IPNs to sync transactions with your system, speeding up reconciliation and reporting.

Smart Features for Invoicing & ERP

Transform your platform with automated reconciliation, localized payments, and programmable financial workflows—all powered by smartIBAN.

Offer merchants alternative payment methods that are cheaper than cards and drive higher conversion rates.

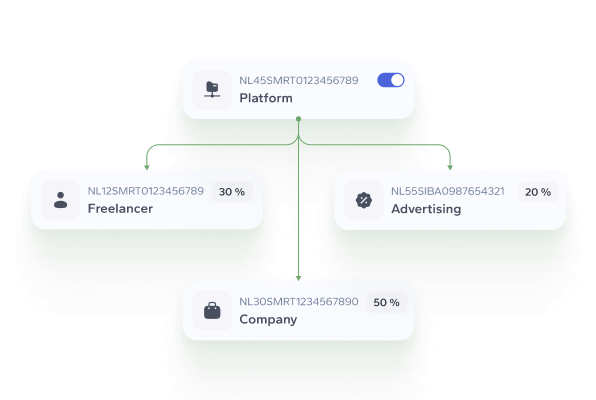

Generate IBANs for merchants to receive payments directly in their name. Automate mass payouts with programmable rules.

Reduce card processing costs and operational overhead by prioritising bank payments.

Set up merchants in as little as 6 hours with instant sub-account creation.

Tailored Solutions PSPs

Auto-split fares between drivers and fleet managers in seconds using programmable rules.

Generate virtual IBANs for merchants to receive payments instantly and automate reconciliation.

Automate payouts to sub-merchants with programmable rules while leveraging smartIBAN’s EMI-compliant infrastructure.

Provide merchants with local IBANs across Europe for seamless cross-border transactions and reduced operational costs.

smartIBAN is GDPR-compliant, EMIL-certified, and trusted by Europe’s leading PSPs.